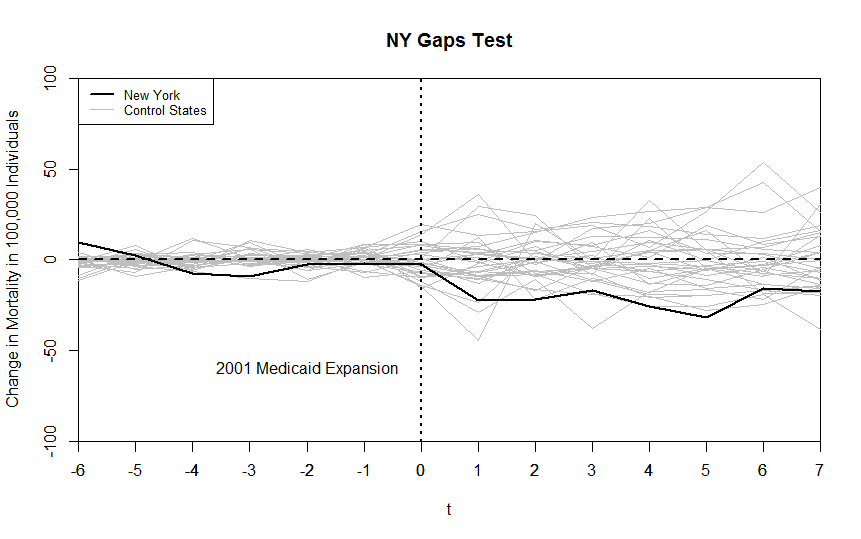

Antonios M. Koumpias, Ph.D., is Assistant Professor of Economics in the department of Social Sciences at the University of Michigan, Dearborn. Prof. Koumpias is an applied microeconomist with research interests in public economics, with an emphasis on behavioral tax compliance, and health economics. In his research, he employs quasi-experimental methods to disentangle the causal impact of policy interventions that occur at the aggregate (e.g. states) or the individual (e.g. taxpayers) level in a comparative case study setting. Namely, he relies on regression discontinuity designs, regression kink designs, matching methods, and synthetic control methods to perform program evaluation that estimates the causal treatment effect of the policy in question. Examples include the use of a regression discontinuity design to estimate the impact of a tax compliance reminders on payments of overdue income tax liabilities in Greece, matching methods to measure the influence of mass media campaigns in Pakistan on income tax filing and the synthetic control method to evaluate the long-term effect of state Medicaid expansions on mortality.